The features affecting cryptocurrency prices include the interaction of supply and demand, moods and attitudes of people, regulatory activities, new technologies, and macroeconomic indicators. Availability is another factor at both the supply side and the demand side, the demand for bitcoins is influenced by factors such as publicity and hypothetical value changes.

Cryptocurrency prices:

The main fair crypto prices are a product of speculation from the buyers and sellers whose judgment on what is a good price can change because of announcements news or underlying technologies. Being flexible and adaptable are the key traits of rising and falling trends no matter what time and place is. There is no simple strategy to predict the future but the volatility of the crypto market is a common failure.The trend of crypto assets seems to be rather challenging coz it is strongly interrelated with many factors. Supply and demand dynamics are fundamental: Commodity price rises because of lack of availability and due to high demand. The human natural instinct of fearing a fall in prices encrusted with the anticipation that would be brought by transaction operators, such as mass media, internet social media, and influencers would definitely result in the price change waves. Similarly, apart from the price clout, regulatory changes have partly caused prices to be on the rise due to stringent positions which generate more expenses, and thus prices have to escalate. However, because of relaxed positions that generate low costs, they fall too. As far as the inflation rates, foreign exchange conditions, and crypto assets development are concerned, these factors can be some of the most significant components in determining the net value or worth of crypto in the industry. Moreover, the competition arising, the customer’s adoption as well as the living uses which are there in the crypto community market will be the main things ethus, the mentioned is above.

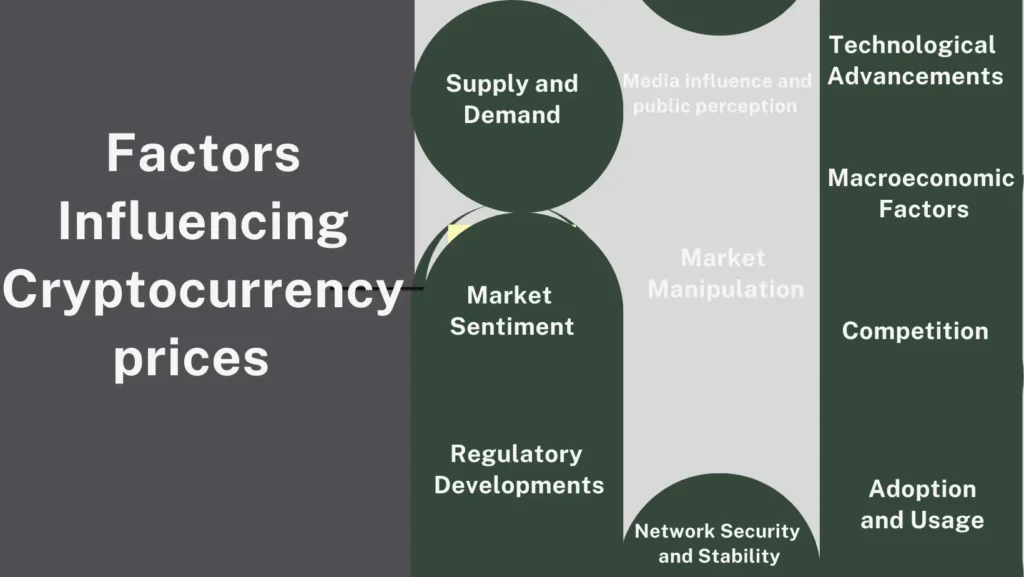

The key factors include:

1. Supply and Demand

2. Market Sentiment

3. Regulatory Developments

4. Technological Advancements

5. Macroeconomic Factors

6. Competition

7. Adoption and Usage

8. Media influence and public perception

9. Market Manipulation

10. network security and stability

Supply and Demand of Cryptocurrency Prices

Surprisingly, the two most crucial parts of cryptocurrency prices are the element of supply and demand. The price of that specific coin will be increased with the demand that exceeds the current supply while the prices will be dropped in cases of less demand. The strict fiat currencies regime highlights BTC as the only one that has a fixed watermark (and it is not more than 21 million). At the same time, the amount of coins for bitcoin buyers has no limit. Such results in a price hike as there are more buyers out there trying to get the same thing. Mining, therefore, affects the price of electricity in a way that rewards the people behind the proof-of-work system in cryptocurrencies.

During the Bitcoin mining process each halving, the reward for such an event is halved about every four years, also referred to as Bitcoin’s halving, which has a profound effect and the price of cryptocurrencies. It is unavoidable because of the coin extinction that comes as part of a given time block. But undoubtedly, except for only a high-priced coin and a low-priced one which is nearly in agreement, there will no trade be happening. An efficient approach to analyzing supply factors and demand factors is the topmost thing in crypto trading to identify trends and act according to cryptocurrency prices.

Market Sentiment

Market mood is displayed as a crucial price determinant through the different public perceptions and emotions of the investors playing the role of the investors. The increase is possible through positive sentiment, which is generally dominated by optimism and confidence, which in turn affects the purchase, resulting in the price that rises as the investors buy in early for the increase. Hence, the contrast might be the negative opinions that are driven by fear and unpredictability and can pull down the market abruptly through the decline of stocks by investors. The news and the markets are situated in such a way, that they help boost people’s emotions and moods.

New regulations, innovations, or collaboration agreements mean positive ways to be conveyed. However, negative news, therefore, from wars, and disasters to legal crises, drives fear which, in return, causes a price dump. Social media-based platforms such as Twitter, Reddit, and Telegram trigger emotions generally and it is the comments from elites as well as celebrities and expert influencers that are the most common triggers of cryptocurrency price fluctuations. Sentiment management is another area of crucial responsibility in crypto trading and this is done by regularly following the media, and social media which give valuable intelligence.

Regulatory Developments

Government policies and regulatory decisions are extremely important and they influence the cryptocurrency prices since they are utilizing this as a medium of exchange. The Legality of Cryptocurrencies is Considered Different by Countries, while if Changes in Regulation Take Place either the Support of Market Growth or its Hindrance can be Observed. More positive legal regulations can enhance the value of the digital asset by annulling the issue of legitimacy and customer reception.

On the contrary, those continent repressive regulations, like the cryptocurrency prohibition decreed by China, can be a powerful price depressor. Tax laws are an element that equally govern investor behavior and determine market prices such as the higher tax on cryptocurrency transactions or holding can make investors more hesitant about investing. Besides the regulations, they deal with such as KYC requirements and AML, which complicate cryptocurrency trading and holding. These markets are so important hence, relevant regulatory knowledge about the US, Europe, and Asia and their impacts on cryptocurrency prices is crucial as a guide.

Technological Advancements in Cryptocurrency Prices

The phenomenon of cryptocurrency sponsored by blockchain technology and allied domains can have a significant influence on prices. ETH2 is a new formation of network upgrade which was adopted. This protocol, the power of which is zero, which is with erasing the hash power that is regarded as verifying the transactions, is one way of making cryptocurrency more appreciable. It increases the effectiveness of data volumes, data security, and efficiency the cryptocurrency prices while growing. Things like a decentralized contract and data safety, which are innovations and they keep progressing with technology instead of destroying it can garner more participation and as a result, attract a higher demand and so, prices.

After the crypto electrification via Lightning Network, the fees become lower, but not for the scarce cryptocurrency that makes it underdeveloped for everyday use and the closer its adoption becomes. Technological improvements such as usability, security, and operability tend to result in the increase of cryptocurrency prices because those same factors added together with the fact that most holders and the majority of the investors’ trusts are mainly due to their viability.

Macroeconomic Factors of Cryptocurrency Prices

Broad economic circumstances including general trends are the main contributors to the degree of cryptocurrency price variability on the label (macroeconomic factors). In practice, cryptocurrencies are used to protect assets from increasing inflation. They may be considered as an alternative to paper currencies in this regard. In the event of an economic slowdown, crisis, or depression, there will be an attempt by investors to invest in an alternative asset such as cryptocurrency. Being so, the valuation of the cryptocurrencies might also be inflated. Technical instruments of monetary policy like adjusting interest rates and doing liquidity provision, which is administered by central banks as well, are known to bring about the changes in the sentiment of investors and the significance of cryptocurrencies.

Consider as an example: Obviously, lower interest rates do some good, especially to the traditional ways of saving and bonds, but people tend to get discouraged because they cannot find higher returns on their investments since they are leaving the market. Finally, we can say that because of international monetary turmoil and variable yet natural factors (such as geopolitics), investors have to keep a part of their portfolio in cryptocurrencies. It is important just to be able to recognize these dynamics and they might occur and investors are therefore not left alone without having information that informs their decisions.

Competition

Thus, the competitiveness of the cryptocurrency market is well known for its fundamental effect. There is seen the birth of new digital coins with high-end features compelling the clients to invest in those projects, meanwhile, competition with them will result in the depreciation of the old currencies. Let us then go for an example: the emergence of a new cryptocurrency that has an upward potential in terms of scalability, security, and functionality over others would inevitably become the talk of the market with its prospects of attracting the return of attention and capital.

Not only the ones aiming to take leadership, as a native digital currency for writing smart contracts on the blockchain technology, for privacy, or in the decentralized finance (DeFi) but even between any of them, multiple interdependencies are happening. Competition during this period becomes very intense, and at the same time new patents are created but at the same time the market is very dynamic and the attention of the customers is captured with the newer product product tracking of online currency projects and setting individual goals of every option is required so that you may see how its universal use will now affect cryptocurrency prices and therefore define your best strategy of investment.

Adoption and Usage

The number of community members that have adopted and the actual users that have the cryptocurrency will indicate the cryptocurrency prices. Increasing the final adoption levels of crypto-currencies is that trading of goods and services will be possible, therefore causing demand and then prices to move upwards. Large-scale acceptance among merchants is a very important ingredient; as long as merchants start to accept a cryptocurrency, the number of people transacting directly with it will be on the rise, giving the cryptocurrency its value. Institutional financial system fundamentally drives the amounts and velocity of crypto use so they significantly determine the activation of cryptocurrency technologies and their broad spread.

The approach of privileged brands and entities in investing in cryptocurrencies results in their recognition and recognition brings confidence among people which consequently affects cryptocurrency prices encouraging their upward trend. The thing is, it is another proof that shareholders like Tesla that people believe in and insert their dollars might cause the prices to move upward due to the known fact that sharing possessions forms a source of confidence. The aberrant environment created by the complicated matrix of applications, wallets, and exchanges substantially enhances functionality and leads to the widespread rate of adoption that is responsible for the majority of crypto prices being widely accepted. The higher the number of people who use these cryptocurrencies, the bigger the chance to see the constant uprise of prices.

Media influence and public perception

The attention and the pictures of the crowds in the media (depending on the appropriate urbanism terminology) have the power to affect the price setting (in crypto-terms). Simply both electronic and other major media outlets have become tools of advertisement bringing up rapidly more and more users that in the long run improve the quality of life of the world currencies. Media talks like R&D, technology, or big money can shine the light on public attention which may also increase the interest and the cryptocurrency prices. Also, the headline which is a part of bad news coverage about picked security breaches or law enforcement scrutiny may trigger the consumer’s emotional response that is known as fear and the price.

Social media channels help these effects to be amplified using rapid transmission of opinions and ideas due to the sharing of information with great swiftness. The hype created by the media and most of the time this hype is based on rosy tales rather than facts is known to lead to speculative bubbles in which prices are highly determined by the zeal for the prospects. An ability to assess what effect the media and public perception have provides investors with the knowledge that helps them make those decisions easier in the market by being aware of the sentimental feelings and guesses price direction and in consequence it makes their investments more successful.

Market Manipulation in Cryptocurrency Prices

The cryptocurrency market is exposed to a number of manipulations that influence the malfunction of the market, which is a major problem. Manipulation through the pump and dump schemes and huge movements of whales makes the cryptocurrency a target. Pump and dump basically means cryptocurrency price manipulation, where gang advocates accumulate the property in a collusion way, and then sell it out in bulk. They cause cryptocurrency prices fluctuation and depending on the liquidity of the portfolio prices swing to either side resulting in the loss of new investors.

The variable that indicates the highest volume among all other classes, commonly known as whales, is usually capable of influencing the market by placing massive orders. Although such whale trading, where crypto is bought or sold in small periods of time dramatically, may cause panic and euphoria om the market characterized by absolute confrontation. , it will always be expressed in a visible price fluctuation. The acts about these issues increase market fluctuation and thus provide complexity in the perception of the discerning the authentic fluctuation from the ones that are unnatural. Identifying the supreme risk of market manipulation and being aware of it should let traders trade more discerningly, responsibly, and without any doubt.

Network Security and Stability

Among the most important pain points of people is enhanced reliability and/or security as an asset class that they can trust and believe the value and stability of the cryptocurrency prices. To be fair, a majority of the threats such as 51% attacks might prove to be a making or breaking factor for the trust attributed to that cryptocurrency hence the subsequent reduction in the value of the cryptocurrency. In this case, the TV set acts as a mirror of regular network television series through a 51% attack which is a falsification of the situation and making double spending using coins. A drop in the value of the coin, avoided by security defects or any hacks of the exchange, wallet, or network, leads to a lack in confidence among the users that getting hold of the cryptocurrency.The equilibrium state also provides the basis for people’s future happiness and trust, which, in the end, increases the power of exchange.

We will establish a secure area, often reviewing for vulnerabilities, which ensures routers, appliance security, and installation of alert systems that respond promptly to threats, thus making networks dependable. Visa, up until very recently, was an old relative who lived by the patterns and never sought any serious improvements. However, it has given enough emphasis to cryptocurrencies which boast of unimpeachable performance without any efforts to intrude from hackers. These are the very realisations for the educated investors and the public which give them a deeper understanding and make them care about this situation. Finally, however, one cannot ignore plans for the possible modifications in the market. Therefore, trading skills of this kind should be aware of dynamic factors related to the cryptocurrency market to provide an opportunity for them to figure out the best decisions, catch up with the opportunities, and manage risk in the cryptocurrency prices.

No Responses